What’s the best core banking software in the world?

- Welcome to Finacle eLearning. EdgeVerve Systems, a wholly owned subsidiary of Infosys, develops innovative software products and offers them on-premise or as cloud-hosted business platforms. Our products help businesses develop deeper connections with stakeholders, power continuous innovation and accelerate growth in the digital world.

- Superb software with simple instructions and simple to use for beginners who learn a lot about the business world accounting using this free version of software available. Would highly recommend to finance people to give your time in learning this software as this is the one software.

Founded in 1981, Infosys Technologies is a software organization that offers a piece of software called Finacle. The Finacle software suite is SaaS software. Finacle offers online, business hours, and 24/7 live support.

Competition in the banking industry is intensifying. Next-generation banks using core banking software are winning market share by targeting lucrative niches in the value chain, forcing incumbent banks to review their legacy platforms.

The good news is that there are a lot of core banking software to help banks modernize quickly and efficiently. Intervalzero rtx runtime.

Core banking(centralized online real-time exchange) is a banking service provided by a group of networked bank branches where customers may access their bank account and perform basic transactions from any of the member branch offices.

In fact, more than 65% of surveyed banks are exploring the potential of next-generation core banking platforms. 70% of banks are now actively reviewing their core banking platforms, according to a McKinsey survey from May 2019.

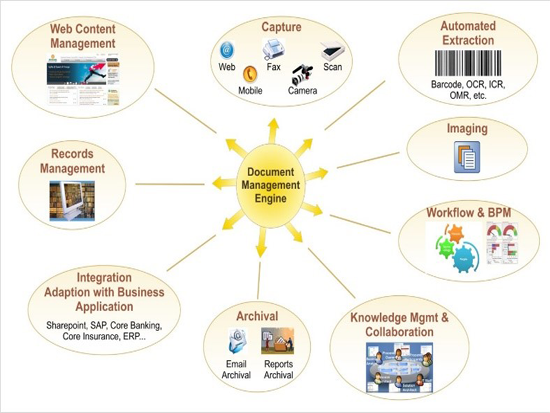

Core banking software is the most crucial part of every bank. Banking software is the engine behind the creation and management of accounts, balances, transactions, journal entries along with the storage of client data, receipts, and other reporting tools.

A good core banking software relies on composable architecture connected by APIs that allows to decouple distribution channels, products, and client data. This particularly agile architecture enables them to make quick changes in core banking software while providing a continuous digital customer experience.

Onboarding, payments processing, card issuing, and KYC services have to be then integrated into the core banking software.

Developing a core banking softwarein-house is a complicated and time-consuming process that can overwhelm teams and delay product launch. As such, very few banks have their own banking platforms.

Revolut, N26, Tandem, O2 Banking have outsourced their core banking software from FinTech providers. New cloud-based platforms with pre-integrated key features help to assemble best in class products and launch them at a much faster pace and lower capital expenditure.

We have prepared the Top Core Banking Software list to talk about the best core banking software in the world.

Top Core Banking Software list

Temenos

Founded in 1993, Temenosis one of the world’s top core banking software systems. After over 25 years of providing best-selling bank software for financial institutions, Temenos boasts unbeatable experience and a wide range of system integrations.

The rich functionality of banking software and cutting-edge technology made Temenos the go-to for over 3,000 current clients and 41 of the world’s top 50 banks, serving more than 500 million customers every day. The banking software platform is designed to help retail, corporate, and private banks manage transactions, risk, enterprise credit, and much more. It offers T24 banking software.

Mambu

As a relative newcomer, core banking software vendor Mambuhas established itself as a rapidly growing supplier of banking solutions. In the two years since its founding in 2011, Mambu’s platform was adopted by 100 microfinance organizations in 26 countries around the world.

Today, the Berlin-based start-up services over 150 banks, fintechs, and telecom companies with over 14 million end-users. Mambu helps prominent companies like Santander, N26, and Orange to rapidly design, launch, and scale their digital-first banking and lending services.

With a banking software built from the cloud upwards, Mambu’s SaaS engine is a powerful alternative to costly and complex traditional core banking The amazing spider man apk download. systems. Besides its cloud approach, Mambu provides its clients with tools to build, integrate, and launch any lending portfolio.

SDK.finance

SDK.finance is the core banking software provider with a strong API layer for banks and FinTechs. Founded in 2013 and based in Vilnius, Lithuania, this banking software vendor offers a highly secure and mobile-ready solution to delight banking customers and take the lead in the open banking world.

A real-time banking processing engine of SDK.finance white label banking software consists of 5 main components: a back-end wrapped in 400+ API endpoints, 3 front-end frameworks, and web for system management with capabilities in iOS and Android for clients. This banking software is flexible and high scalable for the fast-growing banks and financial companies.

SDK.finance enables companies to choose the right model for their needs: SaaS (Cloud Banking) and BaaS banking software or source code with a license.

SDK.finance offers Digital Retail Bank, Power BI Payment Dashboards,Voice payments,Money Transfer,Wallet Engine, Event Payments, and Loyalty Program software in Whitelabel.

SDK.finance is one of the few core software vendors which offers Voice payment technology in banking.

Microsoft Power BI Payment Dashboards generated by SDK.finance is designed for key decision-makers such as CEOs, CFOs, stakeholders, KYC, compliance, financial, and marketing managers to find insights, make confident decisions in different parts of the payments business, and achieve synergy with powerful results.

Click here to learn more about the SDK.finance core banking platform, its features & functionality, use cases, integrations, and API, security, and used technologies.

Backbase

The core banking software vendor of choice of 80+ banks around the world, Backbaseempowers financial institutions to place digital at the core of their business models. The company’s Omni-Channel Banking Platform is the preferred choice for world-renowned institutions such as Barclays, Credit Suisse, Deutsche Bank, Fidelity, ING, and many more.

Since its launch in 2003, Backbase has been helping banks develop a compelling experience on digital channels. Today, the company impacts over 90 million end-customers daily. In-depth focus on customer experience management and unparalleled speed of implementation make Backbase a highly rated FinTech software provider.

Oracle FLEXCUBE

10% of the World’s banked population has an account powered by Oracle FLEXCUBE. 600+ financial institutions use the company’s universal banking solution in 140+ countries across the globe.

The comprehensive, interoperable, and modular bank software addresses core banking needs, enables knowledge workers, and reduces time-to-market for new products. FLEXCUBE’s front-to-back digital capabilities help financial institutions to innovate and create next-generation digital customer experiences.

With access to advanced automation tools that rely on Machine Learning, the company’s clients can generate better insights and enhance straight-through processing. Oracle FLEXCUBE is ideally suited to help companies jumpstart their digital transformation.

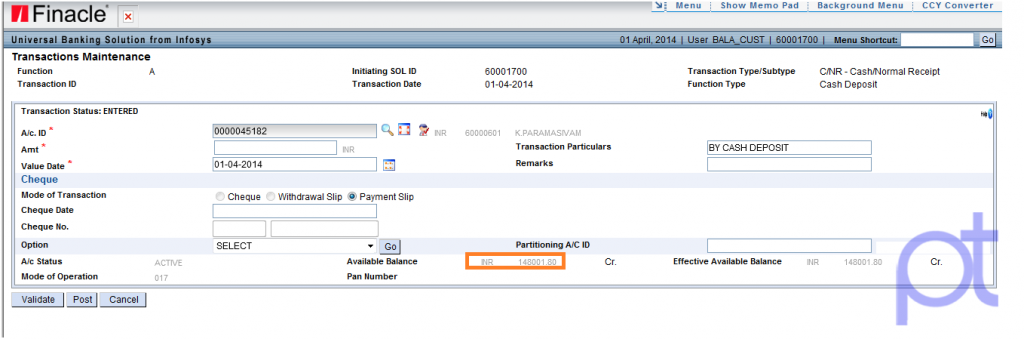

Finacle

Finacle, developed by Infosys, is a cloud-based core banking solution that helps financial institutions modernize their core banking capabilities. The platform is used by banks in 100+ countries and serves 1 billion end-customers worldwide.

With open APIs, embedded customer insights, and a real-time processing engine, Finacle bank software offers a comprehensive set of products that are sure to accelerate innovation-led growth. The highly modular solution was designed to speed up the production of new products and accelerate digital adoption.

A trusted partner to over 1,300 clients, Finacle delivers faster, safer, and fully personalized core banking services.

Finastra

90 of the world’s top 100 banks by asset size are partnered with real-time core banking processing engine Finastra. With clients in 130 countries worldwide and one of the broadest sets of financial software solutions on the market, Finastra is able to serve all functions of all types of financial institutions.

By harnessing the platform’s flexible and open technology, Finastra’s clients can go from legacy banking to transparent, innovative, and agile systems. With Finastra’s modular technology stack, financial institutions can launch and deliver new functionality quickly with less risk.

Comparison Table of Top Core Banking Software Companies

Finacle Software Demo Windows 10

| Temenos | Mambu | Backbase | Oracle FLEXCUBE | Finacle | Finastra | |

| Founded | 1993 | 2011 | 2003 | 1997 | 1999 | 2017 (merger) |

| Number of clients | 3,000 | 150 | 80 | 600+ | 1,300 | 9,000 |

| Headquarters | Geneva, Switzerland | Berlin, Germany | Amsterdam, Netherlands | Mumbai, India | Bangalore, India | London, UK |

| Customer profile | Retail, corporate, universal, private, Islamic and microfinance & community banks. | Alternative lenders (p2p, marketplace personal and SME lenders), deposit-taking institutions, and mobile banking providers. | Financial institutions dealing with retail, corporate, SME, and wealth management with onboarding, loans, etc. | Universal, direct, private, and Islamic banks; financial and lending institutions. | Retail, corporate, universal, community, and Islamic banks; lending and payment providers | Corporate and retail banks, lenders, treasuries, and capital market players |

| Number of end-customers | 500 million | 14 million | 90 million | 380 million | 1 billion | 175 million (retail accounts) |

| Number of employees | 4,600 | 200+ | 800 | 9,000 | 2,800 | 10,000+ |

| Number of offices | 68 | 8 | 9 | 79 | 6 | 60 |

| Solutions | Infinity – Digital Front Office T24 Transact – Core Banking Payments Infinity Wealth Fund Management | Composable banking Cloud banking platform Mambu Process Orchestrator | Retail Banking SME Banking Corporate Banking Wealth Management | Core banking software Enterprise limits Collateral management Investor Servicing Financial Services Lending and Leasing | Corporate, Retail, Universal, Community Banking Suites Payments Connect Digital Engagement Hub | Retail Banking Transaction Banking Treasury and Capital Markets Investment Management |